In the span of just a year, the global pandemic has accelerated innovation, and with it, coworking trends, in commercial real estate. An otherwise steadfast industry, the remote work revolution has uprooted previous assumptions about office space and heralded in a new future of work. Landlords are facing a new reality: traditional office space could become obsolete. To future-proof their portfolios, astute building owners are turning to coworking as an answer, and many are launching their own coworking and flexible office spaces. Why are some building owners choosing to go it alone? A surge in coworking closures, changing demand, and increasingly available management resources and expertise have created a favorable climate for innovative landlords to take the reigns and create their own coworking offerings.

Coworking Trends: Aligning Owner and Tenant Needs

As the pandemic tests the future of the office, “the end of office” is unlikely. Many companies don’t plan on making remote work permanent. Instead, a new movement around flexibility is emerging, which will rethink how the office is going to be utilized when employees return. Companies like Facebook and Microsoft aren’t abandoning physical space. They are simply reevaluating the role of office as an employee benefit, in order to:

- Promote a dynamic company culture

- Sustain long-term employee and company growth

- Drive talent recruitment, connectivity, and retention

This changing role of office necessitates a realignment between landlords and tenants. Companies are increasingly focused beyond square footages, on the performance of office space. Building owners will need to rethink and differentiate their commercial real estate as a product to deliver the best building experience and delight their tenants. A better offering will lead to better outcomes for landlords to:

- Sustain steady, predictable rent payments

- Attract and retain tenants

- Minimize TI spend

- Avoid defaults

A coworking offering presents one key differentiator, or tool, in the landlord toolbox. Previously, many landlords have partnered with third-party providers to offer tenants flexible space. However, as coworking operators increasingly move toward management agreements and take on less risk, they’re no longer signing traditional leases. Coupled with hundreds of operator closures, landlords are now left to figure out what to do with vacant flex space, and many are making the decision to launch their own.

The Top Reasons Why Building Owners Decided to Run Their Own Coworking Spaces

As the flexible space market matures, the economics between owners and coworking operators are changing. Initially, the long-term lease model of WeWork and others helped to reduce vacancies and propelled rents higher. This first wave of coworking was comfortable for owners, with traditional agreements over 10+ year periods. In essence, coworking tenants were similar to other office tenants. However, when operators began giving back space in low-performing markets, financial stresses exposed vulnerabilities in operator business models, who depended on short-term customers to fill long-term commitments (disconnect!). Now, a combination of opportunity and evolving coworking trends are leading building owners to consider running their own coworking and flexible office spaces. The entire commercial real estate industry is undergoing a mind-shift in the way customers are treated.

An Opportunity to Better Service Existing Tenants

Happy tenants drive profit. Tenant retention is one of the most cost-effective strategies building owners can employ, as turnover is costly. To combat churn, building owners are focused on providing an excellent tenant experience. Kingsley Associates reports that 80% of satisfied tenants are strongly likely to renew leases, as compared to 100% of tenants who will not renew due to poor experience. What drives satisfaction? Current tenants need flexibility. Rather than having them leave the building, building owners are listening to coworking trends and considering providing flexible office space in-house

Access to Smaller, Dynamic Tenants

Running a coworking space in your building provides access to a whole new tenant market. The flexibility, low capital outlay, and low-risk commitments attract a different type of tenant: the fast-growing startup. This kind of offering can act as an incubator, with the potential to help tenants move further into the building, and eventually sign larger leases as their companies grow. Bonus? Small teams aren’t the only demographic in need of flexible space. By 2019, enterprise companies represented at least 40% of WeWork’s business. Large corporations need flexible space to manage headcount uncertainty, or to establish spokes in a hub-and-spoke model. By offering a coworking component within the building, landlords open the doors to another type of income stream, with high potential for growth.

Fewer Fees, More Upside

As operators move increasingly toward management agreements, landlords are stuck taking on more risk while still paying high fees. The fees that coworking operators are charging are often more than building owners want to pay. The higher risk associated with these kinds of agreements, coupled with recent headlines around coworking closures, are making landlords more reluctant to turn spaces over to operators. This has accelerated coworking trends towards landlord-operators. Building owners like the Blackstone Group, which manages Willis Tower through EQ Office, have openly spoken about partnering with operators like Industrious to learn, in order to be able to launch their own offering in the long-run. Now, the pandemic may abbreviate these kinds of timelines moving forward.

What Coworking Trends are Enabling Landlords to Pivot Now?

While the pandemic is accelerating decision-making around the future of office, and necessitating landlords to rethink their strategies, a number of other coworking trends are working behind the scenes to enable this transition to owner-operator.

Readily-Available Tech Stack

In the early days of coworking, big operators like Regus and WeWork developed their own technology stacks to streamline their coworking operations. Today, the tech stack required to manage a coworking space is readily available on the market. The list of readily-available coworking space tech, from coworking space management software, to access control, IoT, high-speed WiFi, and visitor management, is getting longer and longer. CRETech is comprised of over 4,000 startups, with more than $12.9 billion invested in 2019 alone. Landlords can now select best-of-breed, scalable, and cost-effective software suites to manage their own coworking offering without having to hire expensive developers. Having this technology not only streamlines day-to-day management, but also unlocks unprecedented access and insights into the tenants that occupy your spaces. Landlords, enabled by technology, have the power to deliver exceptional tenant experiences for occupants, while maximizing efficiency and profitability.

Rising Vacancies

Real estate experts have estimated that as many as 1 in 5 U.S. coworking locations, totaling an estimated 25M square feet, will close or change hands as a result of the Coronavirus pandemic. An Upsuite Report found that over 226 locations, 20,000 seats closed in 2020, which represents a reduction in just under 6% of the 4,000 locations that Upsuite tracks. Since then, these coworking trends continue, with Breather having closed its 400+ locations. For building owners, closures represent vacant space within their buildings, and they are faced with 2 options: find a long-term tenant, or take over management. Plagued with low occupancy, sublease, and now returned space from operators, many building owners are considering coworking or flexible office as a way forward to monetize the available space.

Strong Talent Pool

No coworking space will run itself, no matter how good the tech stack. The second key ingredient to operating your own coworking space is to hire experienced talent. Fortunately for owners, the pool has widened significantly in the last year, following thousands of layoffs from WeWork, Knotel and Convene. While some owners are learning from their operator partners, others have the opportunity to simply hire those their partners have trained for years. Companies like CBRE have already used this strategy, leaning on ex-WeWork talent to launch their own coworking brands. In the words of Malcolm Glazer, owner of the Buccaneers, “if you want to know the road ahead, ask the person who’s been there.” In other words, find and hire your Tom Brady.

The Types of Landlords Considering Their Own Coworking Spaces

Innovative, bigger landlords (and real estate services firms) are well-equipped to reinvent a better product, whether from scratch or through the acquisition of an already-established coworking brand. Landlords with larger portfolios can benefit from the scale that existing CRETech stacks unlock to operate their own offerings. Early adoption can serve to differentiate their brand as an innovator and thought-leader in the space. The offering will also serve to differentiate their building, whether from the rest of the block, or regionally as a desirable offering for high-growth tenants. It is worth mentioning that coworking is not the only type of flexible office that owners are poised to offer; many building owners already command executive and spec suites, as well as other types of spaces that can be activated with this model. Many are already making plans. Real estate services firm, Newmark, recently announced their strategic investment in Knotel to increase occupancy and building revenue with a full-service product. And building owners like Brookfield have considered major investments in the last couple of years, including purchasing IWG. Others have made the plunge, operating their own coworking spaces within their buildings.

Leading The Coworking Trends: These Building Owners are Already Running Their Own Coworking Spaces

While some owners are still weighing their options, a group of early adopters is already successfully operating their own coworking spaces, with many actively expanding beyond their own portfolios

1. Tishman Speyer: Studio

Tishman Speyer launched its Studio coworking brand as an amenity and service package to improve tenant experience and help tenants grow within its buildings. Since its debut in 2018, Studio has expanded to multiple markets, with a focus on NYC. Companies leverage Studio in many ways, including HQs, new market expansions, temporary overflow, and flexible headcount growth.

Markets: Multiple, focus on NYC

Reason: The opportunity to service tenants better and access smaller, more dynamic tenants.

How it’s going:

“We have invested in Studio to meet the evolving needs of our customers, whether they are looking for a new home with greater flexibility, need flexible space to complement their traditional space or are expanding into a new market, we want to give our customers whatever they need.” — Thais Galli, Managing Director and Head of Studio at Tishman Speyer

2. Boxer Property: Workstyle

Boxer launched its Workstyle program in 2013 to serve the flexibility needs of individuals and small companies through coworking. Boxer offers a collection of upscale open offices and amenities, from desk space to executive suites, to reach the modern small business.

Markets: Multiple, focus on Dallas and Houston

Reason: Access to smaller, more dynamic tenants

How it’s going:

“Some companies have built tens of millions of square feet that is fixed and static. It cannot adapt to the next user coming in.” – Justin Segal, President

3. MRP Realty: Heyday Properties

MRP Realty’s Heyday Properties is an innovative property management company designed to change the tenant experience with a hotel-style offering that includes amenities and coworking.

Markets: Washington DC, Nashville, Philadelphia

Reason: Want to solve the needs of all types of tenants

How it’s going: Heyday is seeing increased demand for flexible leasing solutions. They have been able to grow the initial portfolio in year 1 by 3x the square footage.

4. SL Green: Emerge 212

SL Green embraced coworking trends with Emerge 212, which provides flexible office solutions to allow tenants to minimize the overhead and restrictive terms of traditional leases. Since the pandemic, they’ve also expanded their offering to include Virtual Offices spaces.

Markets: NYC

Reason: Service tenants better and access smaller, more dynamic tenants.

What is Next for Building Owners interested in Coworking?

What is Next for Building Owners interested in Coworking? Productizing your office space, and expanding your offering will depend on your unique circumstance. To continue to track coworking activity and decide on your next steps, you can start by:

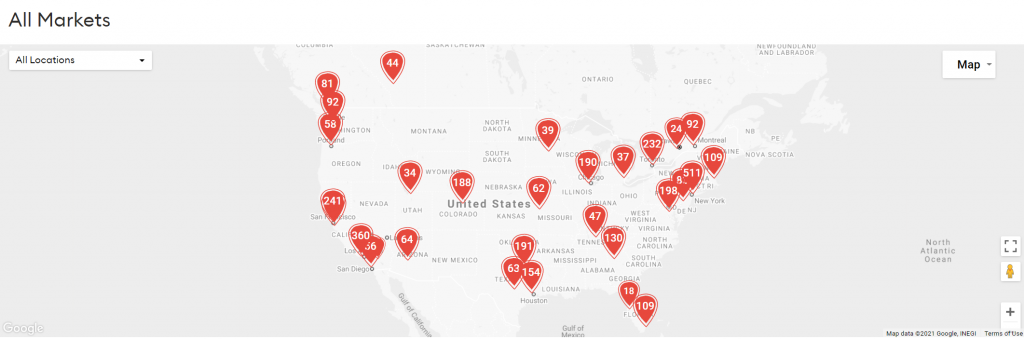

- View a map of all coworking locations.

- Consult Upsuite’s services for owners.

- Schedule a meeting with one of Upsuite’s advisors.

This Post Has 0 Comments