The Covid pandemic took a major toll on the flex office industry causing hundreds of permanent coworking closures. We recently reported that demand for flexible office in the United States has not only recovered, it is also now higher than it was pre-Covid. We’ve now tracked over 800 closures of coworking spaces in North America since the start of the Pandemic, and with rising demand, these vacant properties provide operators with a unique opportunity to expand their business.

What is Happening to Former Coworking Closures?

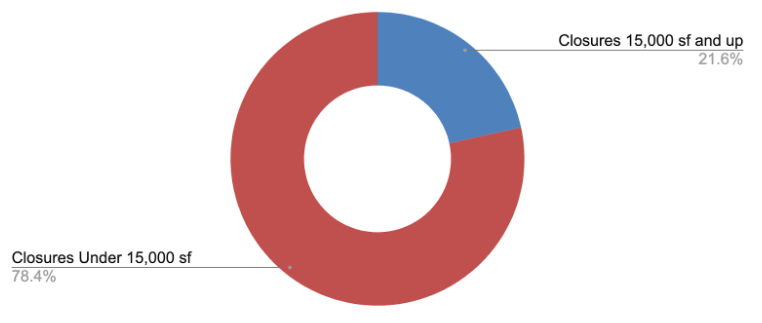

In total, roughly 22% of all centers we track closed from 2020 to 2022. Of those, the vast majority of centers, 78%, were smaller than 15,000 square feet.

Even though most centers were fairly small, the closures totaled nearly 10 million square feet of office space given back to the market. As overall office demand returns, direct tenants are the primary force driving the leasing of former coworking spaces that are smaller than 15,000 square feet. These smaller offices represent an opportunity for direct tenants to come in and lease new, high-quality offices for their team.

The Opportunity for Coworking Operators

Coworking closures represent low-cost opportunities for new operators to take over a property and reopen it under their brand — for a fraction of the cost. The spaces are already built out for coworking and are available at market rates. Smaller spaces are also preferable for some direct/private tenants, as the vast majority are only looking for space that is 15,000 square feet or more.

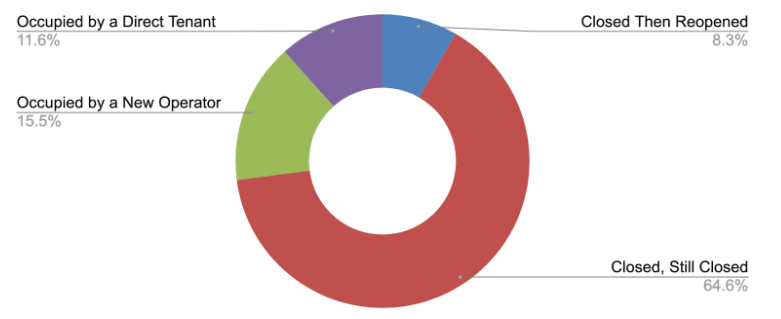

Of the 15,000 square foot spaces that were formerly coworking, nearly ⅔ have yet to be taken over. Only about 16% are occupied by a new operator, with about 12% secured directly as an office for a single private tenant and their employees. An additional 8 percent of the closures we tracked are now re-opened by the same operator who once closed the space.

The 65% of closed spaces that remain closed represent a huge opportunity for operators in search of new space, and many operators have already taken advantage.

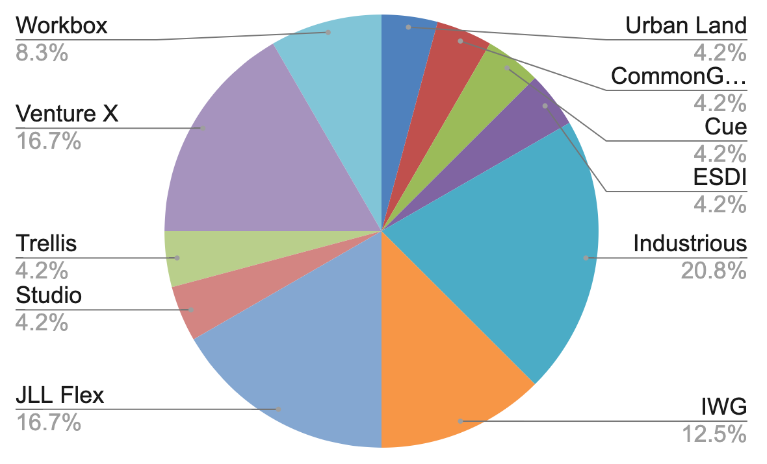

Referring to the chart below, Industrious is the leader in takeovers, while Venture X and JLL Flex are tied for second place. IWG, the largest operator in the world, is in fourth place. Interestingly, the second-largest operator in the world, WeWork, hasn’t taken over any space, though they did purchase Texas-based Common Desk.

WeWork hasn’t completed any takeovers but has instead had more of its former spaces taken over by competing operators than any other provider. This is followed closely by Industrious, Make Offices and Serendipity Labs. The graphic below details the companies that had their spaces taken over by competitors the most.

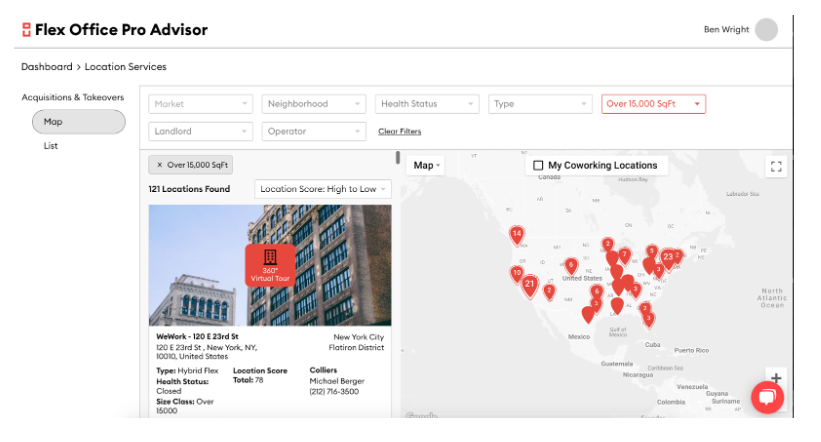

Where Are Many of the Remaining Closed Locations or Takeover Opportunities Located?

The largest number of remaining takeover opportunities are located in New York, Los Angeles, San Francisco, Denver, and Chicago.

What’s Next?

Two-thirds of the fully built out coworking spaces that are 15,000 square feet and larger that closed during the pandemic are still available. These centers represent an opportunity to open a new center for up to 75% less upfront investment than opening a new space. Operators can also negotiate more favorable terms with landlords, and open centers on an accelerated timeline.

About SquareFoot

SquareFoot is a new kind of commercial real estate company that helps businesses solve all of their real estate needs. With a tech-enabled listings platform, extensive flexible office inventory, and a dedicated brokerage services team, SquareFoot creates a transparent, user-friendly office search experience for tenants. Headquartered in New York City, SquareFoot serves 30+ markets across North America.

Flexible Office Solutions by SquareFoot

SquareFoot’s Flexible Solutions Team offers businesses a tech-powered network of private office suites, shared offices, and meeting spaces, all with flexible terms. Available through SquareFoot.com, Upsuite.com, and PivotDesk.com, and serviced by the company’s dedicated Flexible Solutions Team (FST), SquareFoot’s network of 50,000+ spaces allows businesses to identify and rent spaces that suit their unique and evolving needs — all while getting the best deal available. SquareFoot’s Flexible Solutions Team saves you 90% of the time you’d otherwise spend sourcing, contracting, and managing your real estate and up to 50% off of asking rents.

About Upsuite

Acquired by SquareFoot in spring 2021, Upsuite offers coworking and flexible offices in 35+ North American markets that are conveniently located, meet your budget, and on your terms.

Unlike doing time-consuming Google searches and tours yourself, Upsuite helps you find and secure an office in 90% less time, and save as much as 50% on rental costs by providing 99% of the market inventory, actual suite availability, and pricing, and a helpful Advisor.

After buildout is over, consider the ongoing costs of maintaining a coworking space, such as taxes and maintenance.

This Post Has 0 Comments