Coworking Trends: Five Markets Where Coworking Demand has Returned [2021]

Commercial real estate is in the midst of a massive and fast recovery and coworking in key cities like San Francisco and New York City is leading the way. While coworking trends in many markets were dramatically impacted by the pandemic and economic downturn, coronavirus has cemented flexible office as a mainstay workplace solution. In short, the pandemic has made coworking more appealing. ****

Trying to Find Your Target Market as a Coworking Operator?

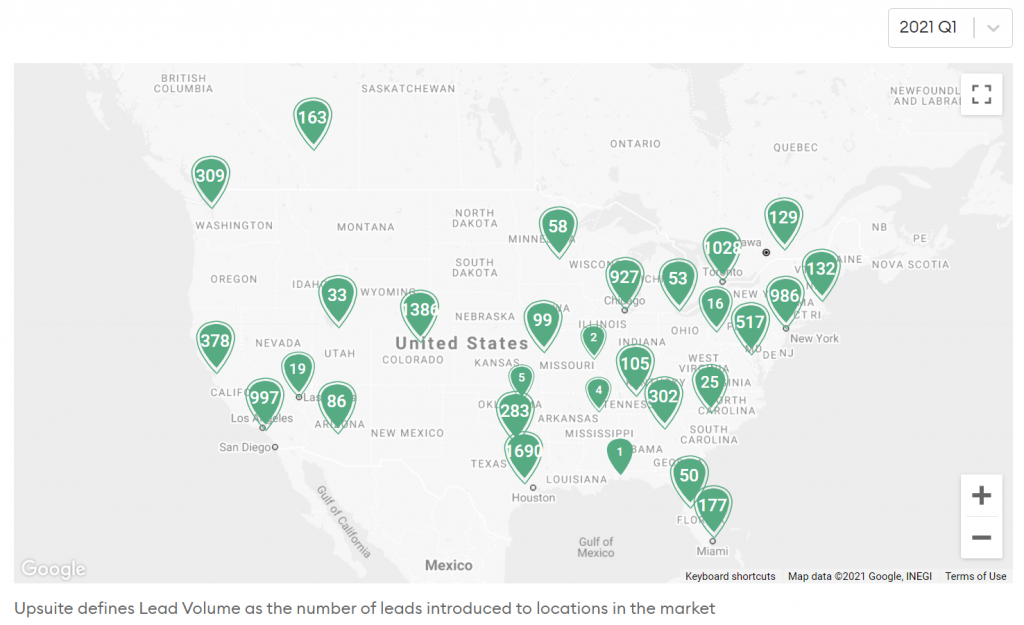

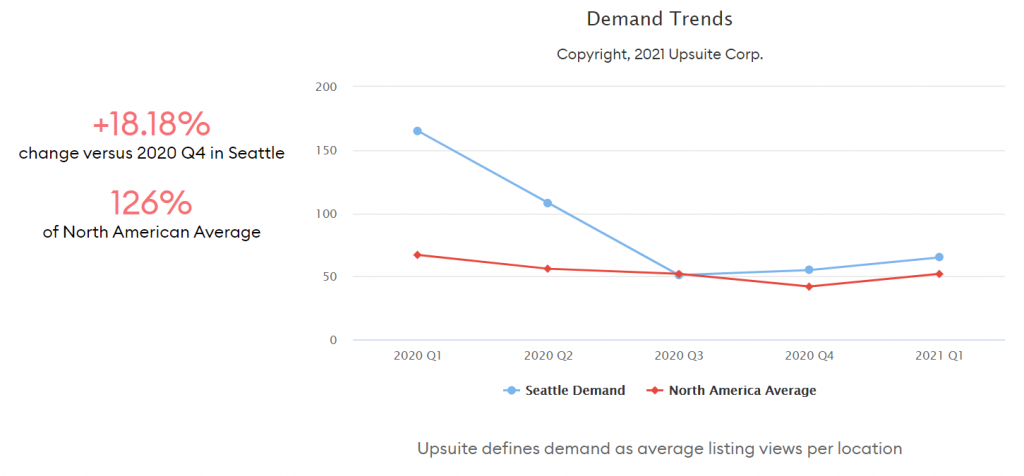

Nationally, the demand for flexible office and coworking space has gradually increased by 21% from Q4 2020 to Q1 2021, led by growth in key urban centers. As many companies and cities are navigating the return to work, different markets are behaving differently, but one thing is clear: cities are not dead – at least not when it comes to demand for coworking and flexible space.

Coworking Trends: Demand Increased by 21% in Q1 2021

The core value proposition of coworking and flexible space — lease flexibility, cost-effective rates and easy access — has made flexible space the preferred option for many companies navigating their way out of the pandemic. Upsuite Flex Office Pro has tracked a 21% increase in demand from Q4 2020 to Q1 2021. This demand, measured both in number and size of leads, shows coworking trends are up and to the right. Although demand fluctuated widely throughout the pandemic, the national recovery in 2021 has been steady. The contribution to this growth in demand varies by market, with lockdowns and vaccination rates playing a large role in reopening.

Coworking Demand Returned Earliest in Gateway Cities

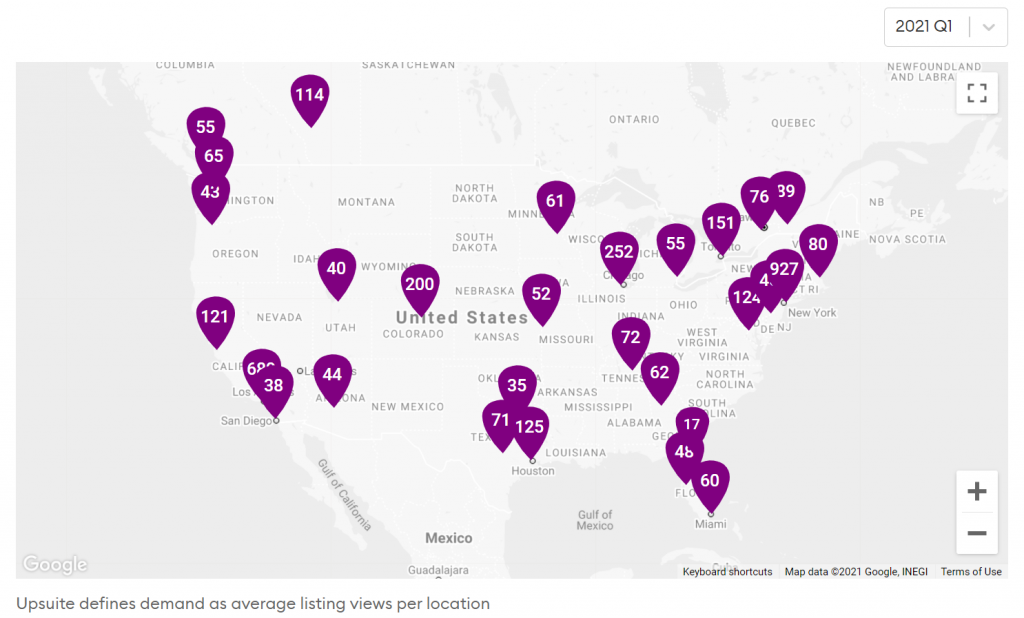

Despite new demand for coworking coming to suburban markets in 2020, North American gateway cities continue to lead coworking trends. In fact, demand since Q4 2020 for coworking and flexible office in key urban centers is resurging at up to double the national average.

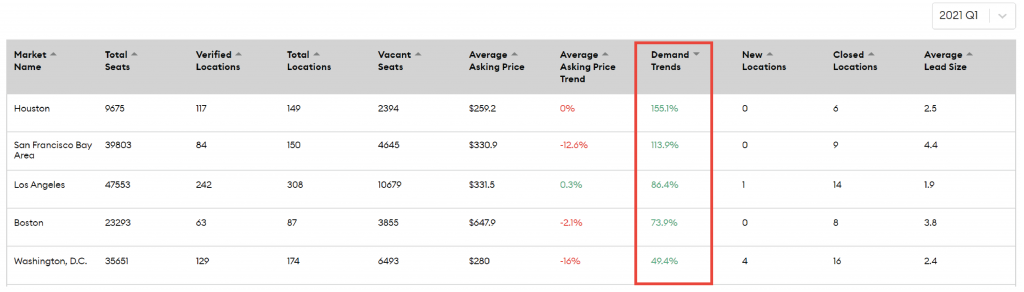

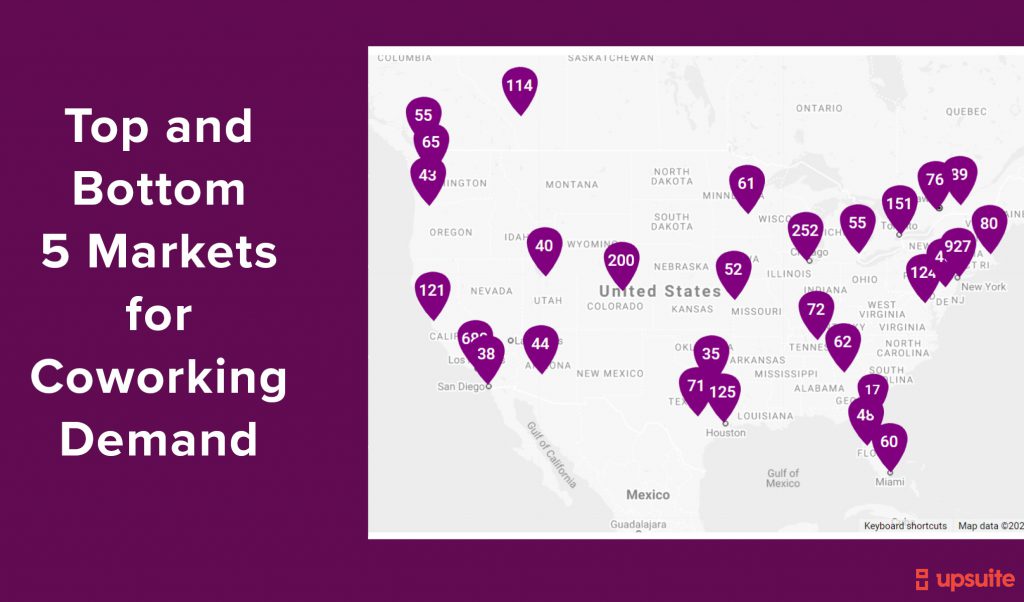

The top 5 coworking markets where demand has returned the earliest are Houston, Washington, D.C., San Francisco, Los Angeles and Boston. In these cities, occupiers are actively searching for flexible workspace as they navigate they rebuild a post-COVID workplace , fraught with many unknowns. This uncertainty has made flexible workspace the preferred option for many companies returning to work in a physical office space. As a result, average listing views are skyrocketing in these primary markets.

Views in search for cities like Los Angeles doubled since the end of 2020, with 689 average listing views per location in Q1 2021 , and many other markets like New York City are seeing demand surge by more than 30% quarter-over-quarter. New York City’s whopping 927 average listing views per search say one thing loud and clear: cities aren’t dead (Seinfeld was right!) and the major coworking markets are regaining their strong pre-pandemic footing, poised for rapid growth as business reintroduce their employees to physical workspace.

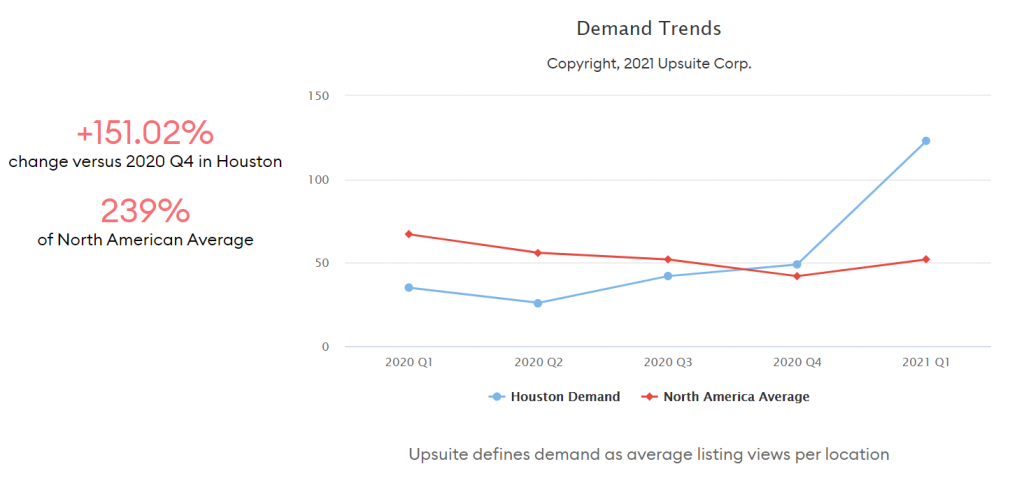

1. Houston

Houston coworking trends in demand grew more than 150% in Q1 2020. On average, occupiers are viewing listings at more than double the national average in this market. Due to the relatively shorter lockdown in Texas as compared to many other states, Houston’s commercial real estate market has had a longer time to recover, and demand there has been growing since Q2 2020. No doubt, this trend will likely continue, with 2021 catapulting Houston to the #1 market for coworking and flexible office demand.

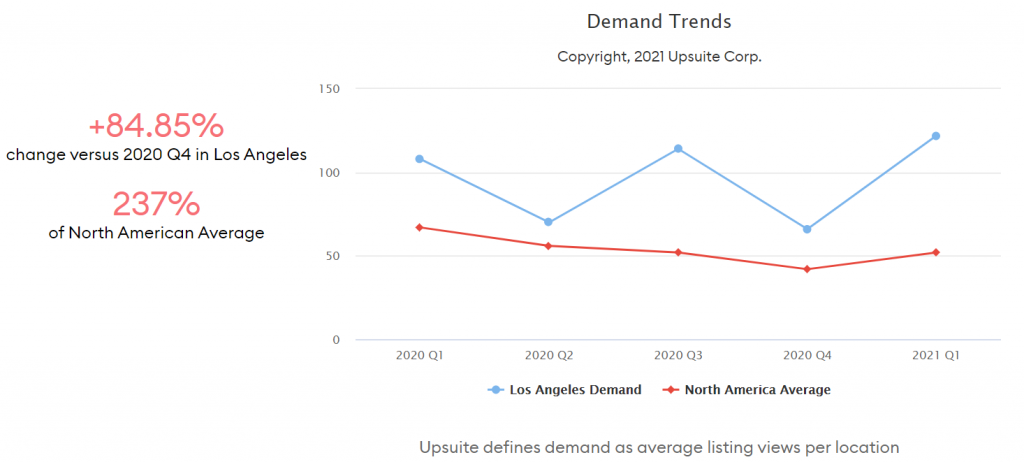

2. Los Angeles

Los Angeles coworking trends in demand have increased nearly 85% sine Q4 2020, and also represent more than double the national average. During the 2020 pandemic year, demand fluctuated greatly, increasing and dropping back to a low point at the end of 2020. Q1 2021 represents a fresh start with sustained growth in demand forecast for the rest of the year.

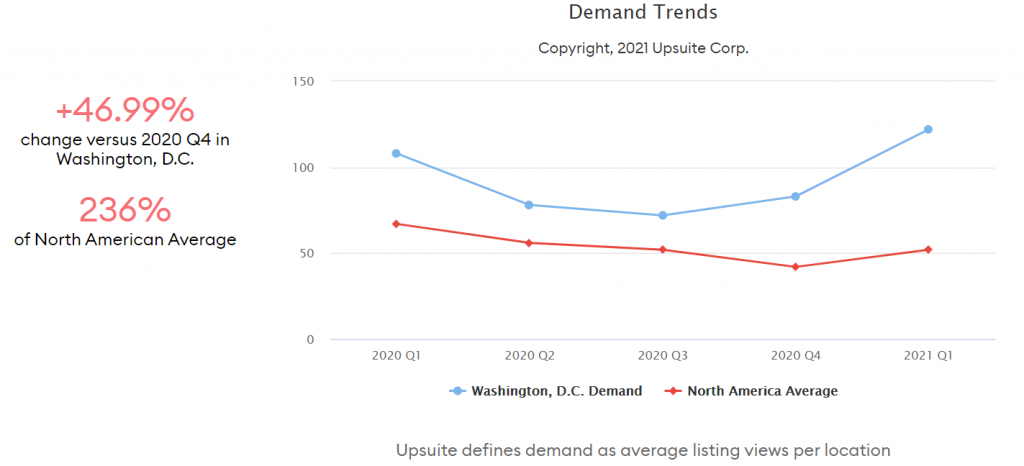

3. Washington, D.C.

Coworking trends for Washington, D.C. show an almost 50% quarter-over-quarter increase in demand since the end of 2020. Like Houston, its average listing views per locations represent more than double the national average. And although demand in Washington, D.C. has been rising since Q3 2020, Q1 2021 represents the largest rate of increase since pre-pandemic.

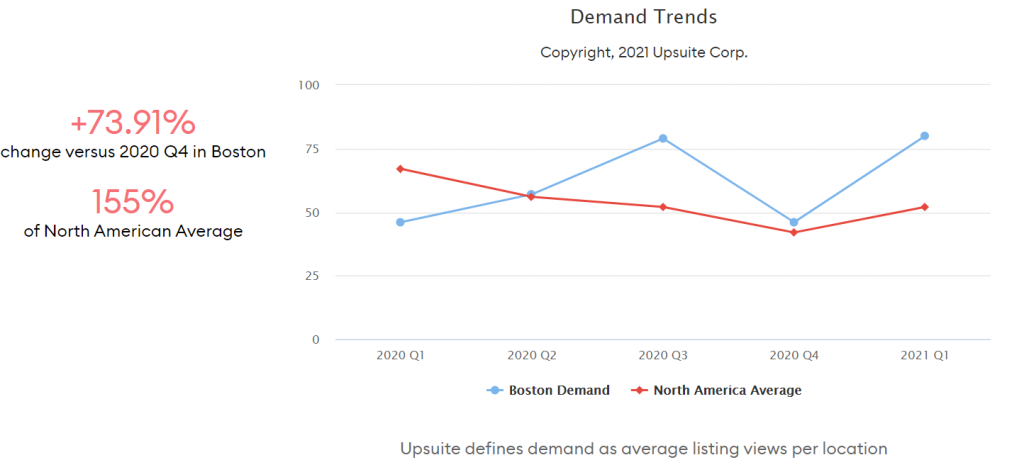

4. Boston

Boston has seen an almost three-quarter growth in demand trends since the end of 2020. Its average listing views per locations represent over 150% the national average following a quick and successful vaccination campaign.

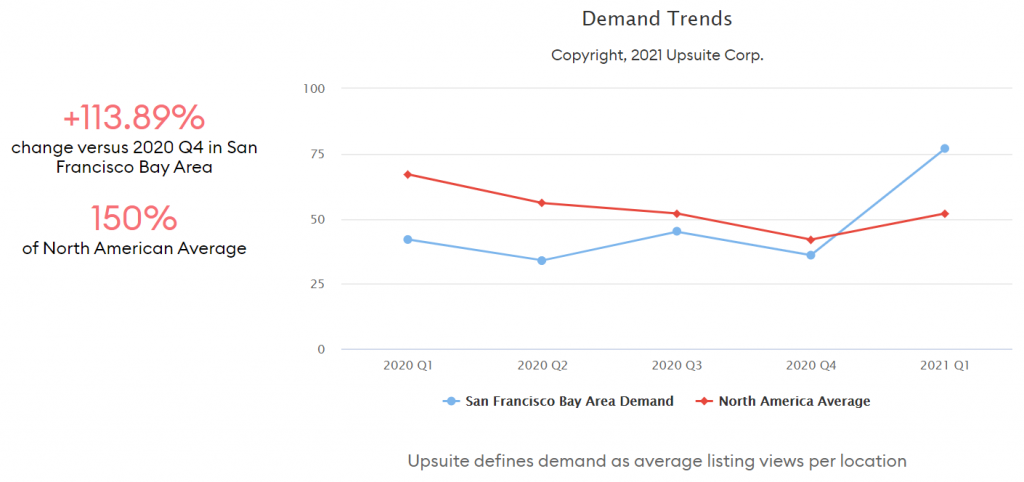

5. San Francisco Bay Area

San Francisco coworking trends in demand wobbled throughout the pandemic, but have since doubled. This city is coming back in a strong way in 2021 after a series of repeat lockdowns, at 150% of the North American average.

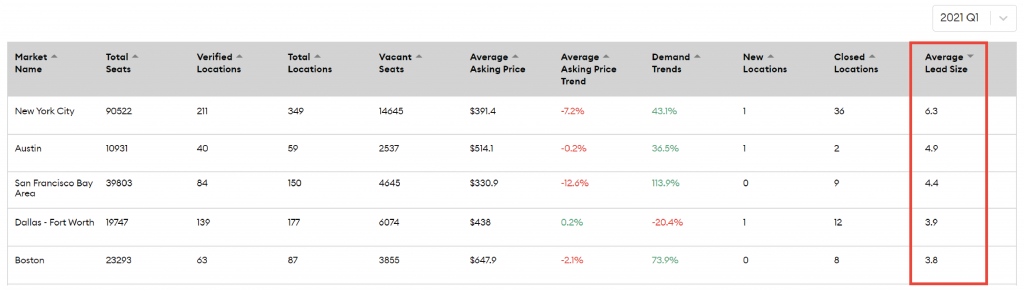

Coworking Trends: Markets like San Francisco and New York saw Largest Average Lead Sizes

Upsuite measures growth in demand not only in the number, but also in the average size of leads. The top 5 North American markets with the largest average lead sizes in Q1 2021 were San Francisco, Boston, Austin, New York City, and Dallas. In these markets, occupiers are searching for coworking and flexible office spaces that support, on average, 3-6 people. One pandemic-driven coworking trend is a surge in private office demand, with pricing increasing for this space offering in response to rising demand in many of these markets. The average lead sizes in these top 5 markets were:

- New York City: 6.3 seats

- Austin: 4.9 seats

- San Francisco Bay Area: 4.4 seats

- Dallas – Fort Worth: 3.9 seats

- Boston: 3.8 seats

Pre-pandemic, the largest average lead sizes spanned 10-40 people in some coworking markets. 2021 lead sizes are lower. This may be because firms aren’t taking flexible space for whole business units, and instead may be catering to a more decentralized and remote workforce that’s clamoring for better office space for at least part of the week to meet with their close team members or have focus space away from home.

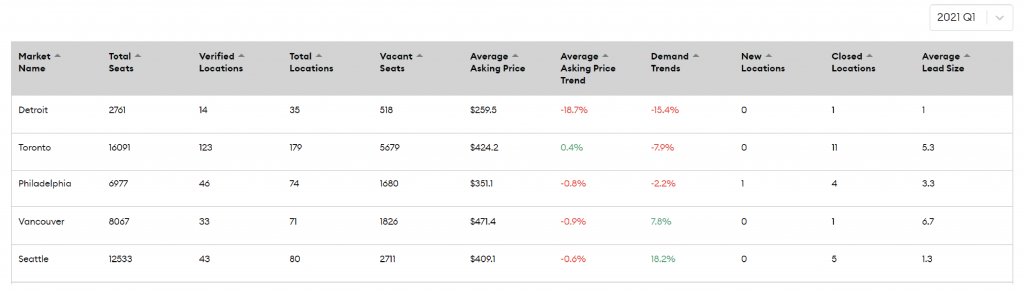

Some Markets like Toronto and Detroit Continue to Struggle

Amidst an overall positive outlook for coworking trends, gradual national recovery and spiking demand for coworking and flexible space in key markets, there are still some markets where the effects of COVID-19 are not over. The 5 North American markets with lowest coworking demand are Detroit, Toronto, Philadelphia, Vancouver and Seattle.

North America’s lowest markets for coworking demand in Q1 2021. (Source: Upsuite Flex Office Pro Market Data and Insights Platform)

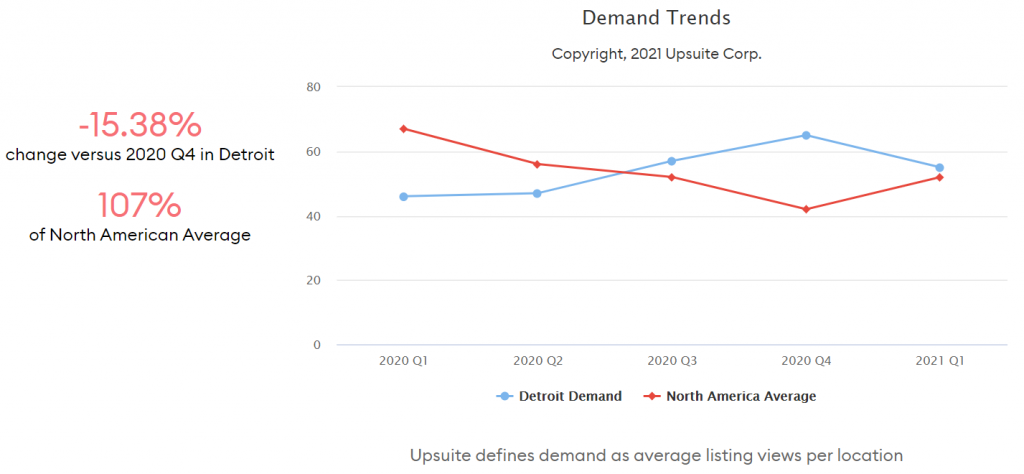

1. Detroit

Detroit coworking trends in demand have behaved in the opposite direction of the national average since the start of the pandemic. Initially, demand in the market grew from Q2 2020 until the end of the year, but has since decreased in Q1 2021 back down to match the national average.

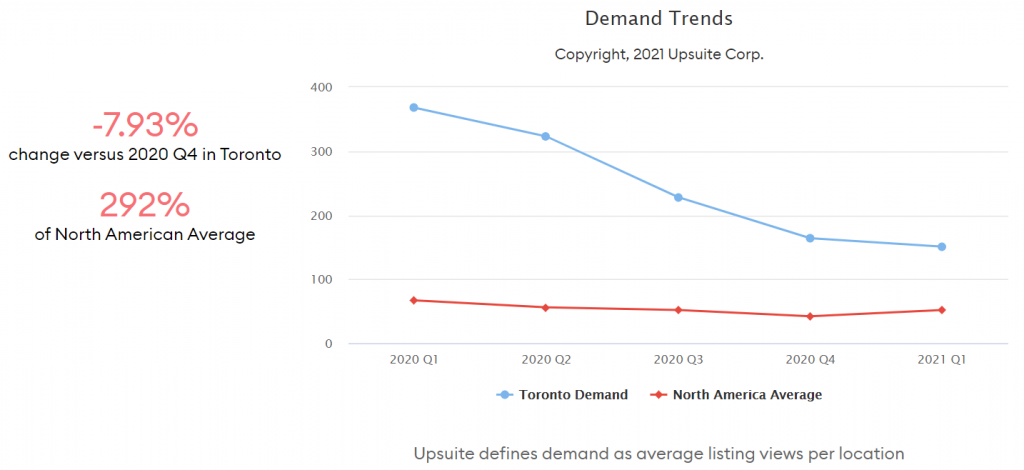

2. Toronto

Canada’s recovery from COVID-19 has been slowed by lack of access to vaccinations and continued lockdowns. As a result, demand for coworking and flexible office has continued to fall in Toronto, though the rate of decrease has slowed. Demand trends are only 8% lower in Q1 2021 than the previous quarter, and they still present double the national average, as Toronto continues to be a strong market, though in a much weaker position than this time last year.

3. Philadelphia

Philadelphia coworking trends in demand sunk during 2020, and sit 12% lower than the North American average. A smaller market than New York City or Washington, D.C. nearby, it is has yet to see a positive increase in average views per listing.

4. Vancouver

Like Toronto, Vancouver continues to struggle with the effects of COVID-19. While this market did see a positive change in average listings per view in Q1 2020, it hovered only around 8%, and has yet to recover to pre-pandemic levels.

5. Seattle

Seattle demand for coworking plummeted in 2020, and has been only gradually recovering at 18% quarter-over-quarter since the end last year. Unlike many U.S. gateway cities, its average listings per location remain well below half of what they used to be.

Coworking Trends Forecast to Skyrocket in Q2 2021

Despite some markets continuing to struggle with the effects of COVID-19, the majority of North American coworking and flexible office space demand is on the rebound. What is the forecast for demand increases in Q2?

Commercial real estate is on the cusp of a massive recovery, led by coworking and flexible office space. Flexible office presents the fastest and easiest opportunity over traditional long-term leasing processes, and is therefore ideally positioned to capture the resurgence in demand for workspace as businesses return to work. And while growth has been gradual between the end of 2020 and the end of Q1 2021, we’re starting to see a spike in many markets like San Francisco and New York City, particularly in April and May, that’s blowing us away.

What this Means for Operators

The pandemic has shown that coworking demand is returning, led by major urban areas that were previously pronounced “dead” as a result of the pandemic. As occupiers return to physical workspace, the world of flex is uniquely positioned to capture this demand thanks to lease flexibility, cost-effective rates and easy access. . Operators have an opportunity to concentrate on the markets where demand is returning, like San Francisco, New York City, Houston, Boston, and Los Angeles. To continue to track coworking activity and decide on your next steps, you can start by:

- Read our “Find Your Target Market” blog post

- Get the data to understand key coworking trends across North American coworking markets.

- Schedule a meeting with one of Upsuite’s advisors

We hope that this post is helpful as you decide what to do next. If you have questions or want to talk, please schedule a call with us to discuss your options. We are here to help.

This Post Has 0 Comments