2021 Coworking Trends: The Five Most and Five Least Expensive Coworking Markets

The Flexible Office and Coworking Industry is just that: Flexible. This means that coworking trends in pricing can vary quarter to quarter and market to market, especially in a year hit hard by the COVID-19 pandemic. One thing the pandemic has shown us is that pricing has more to do with supply and demand than underlying real estate costs. In fact, demand is spreading to secondary markets, and in North America’s most expensive cities, the coworking and flexible office price per seat is decreasing. For operators in the top 5 most expensive coworking markets, like Boston, New York City and Austin, right-sizing pricing will be critical to drive deals. For occupiers ready to act, high price fluctuation could present leverage to get the best value.

Why Coworking is Still Working

Last year saw one in five (21%) of U.S. and Canadian coworking locations close. These coworking closures were dominated by large, well-funded operators such as Breather, WeWork, Knotel, and Serendipity Labs, who used the pandemic as an opportunity to close underperforming locations and future-proof their portfolio. Now, with coworking trends on the road to recovery, these and other strategic flexible space operators are well-positioned to support new demand and ride post-COVID-19 office trends to growth. This perseverance is a testament to the strength of the flexible office market.

Why is coworking and flexible office more attractive than ever? The main reason is an increasingly mobile workforce. Companies are navigating the post-pandemic uncertainty with a more decentralized and remote workforce. Short-term flexibility has become even more desirable than regular long-term office leases through the course of the pandemic, companies need help to adjust to hybrid office trends. Many companies are adopting a hybrid model where some of their employees work remotely some of the time. As the purpose of the office is reconsidered as a space for learning development, collaboration and socializing, the conversation is moving towards a workplace ecosystem where flexible space is one strong tool in the employer toolbox.

Coworking Demand is Up While Pricing Continues to Decrease in Gateway Cities

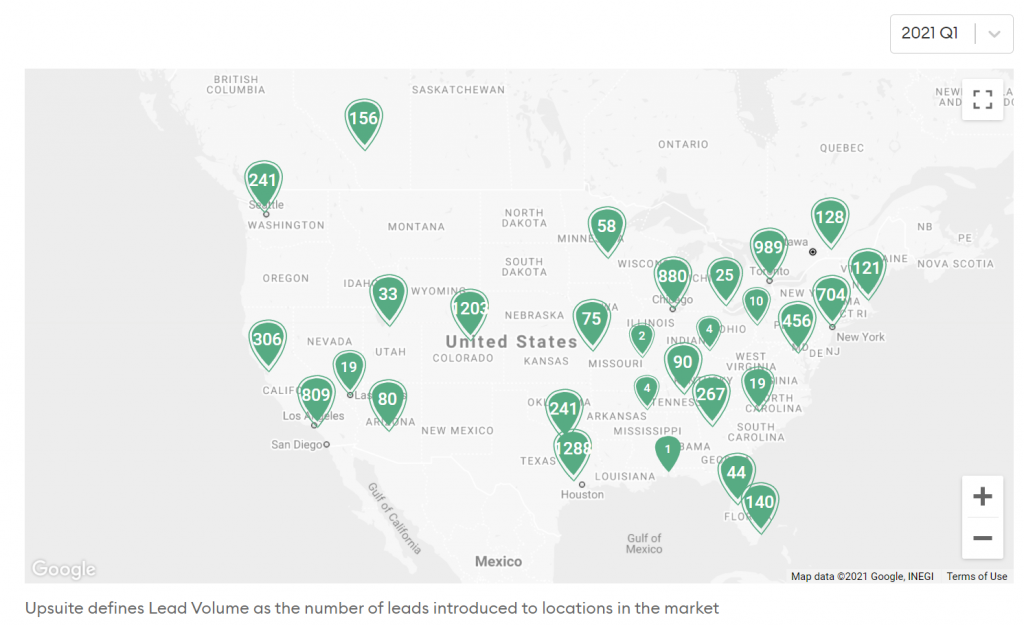

Coworking trends are responding accordingly: occupier demand is back on the rise in Q1 2021, and U.S. average asking price trends are starting to steady. This is creating interesting opportunities for occupiers and operators alike in different markets.

- Demand trends are exploding in some markets (150% in Houston) vs only 6 markets are still trending negative (Dallas at -20%).

- U.S. average asking price per seat decreased due to the pandemic, but only by 10% for floating desks, and 5% for private offices and suites.

- Average asking price trends are still trending down in gateway cities, but have stabilized in most secondary markets.

(Source: Upsuite Flex Office Pro Market Data and Insights Platform)

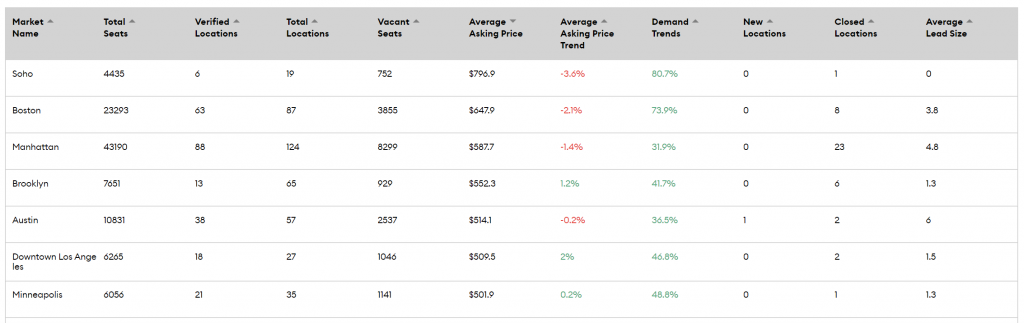

The Top 5 Most Expensive Coworking Markets

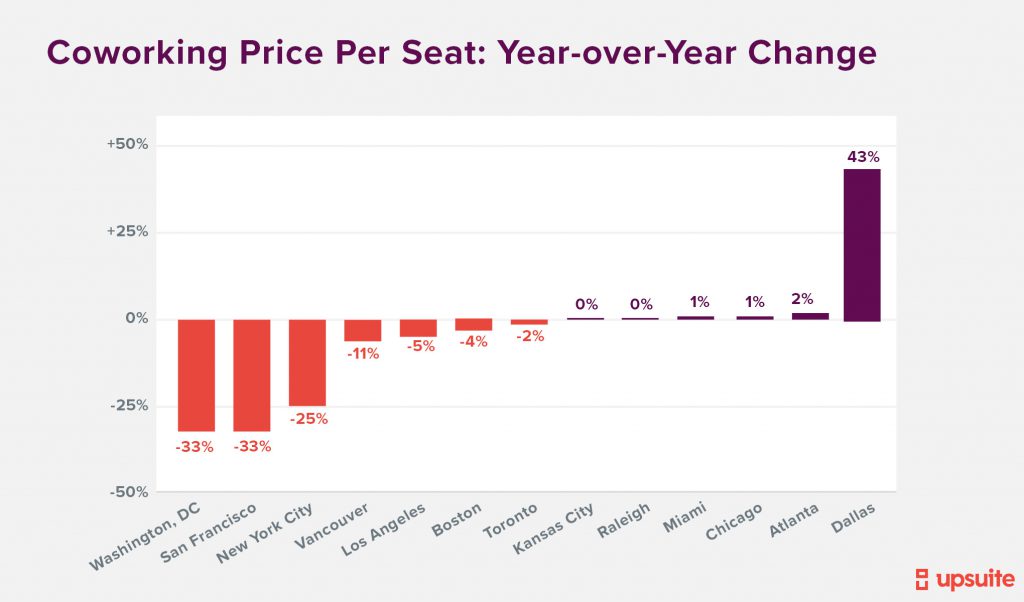

As of Q1 2021, Boston, New York City, Austin, Los Angeles and Minneapolis are North America’s most expensive coworking markets. And while occupier demand is starting to rise again, increasing between 40%-80% since Q4 2020, the overall price per seat is still lower than pre-pandemic In many of these top markets, the average asking price per seat in Q1 2021 decreased significantly as compared to the same period last year. In New York City, pricing has dropped by 33%.

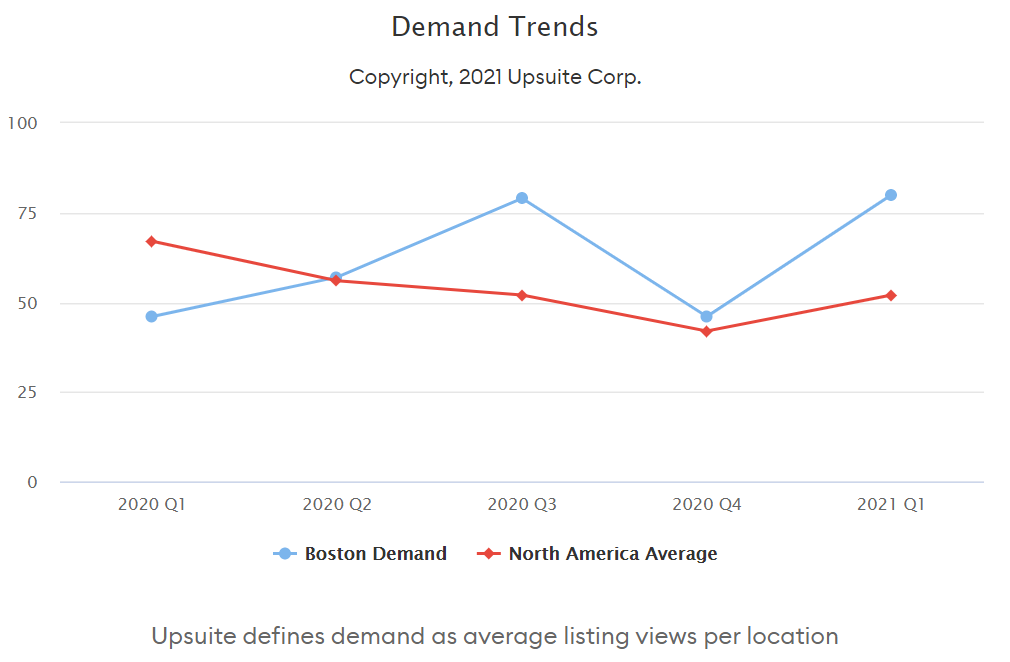

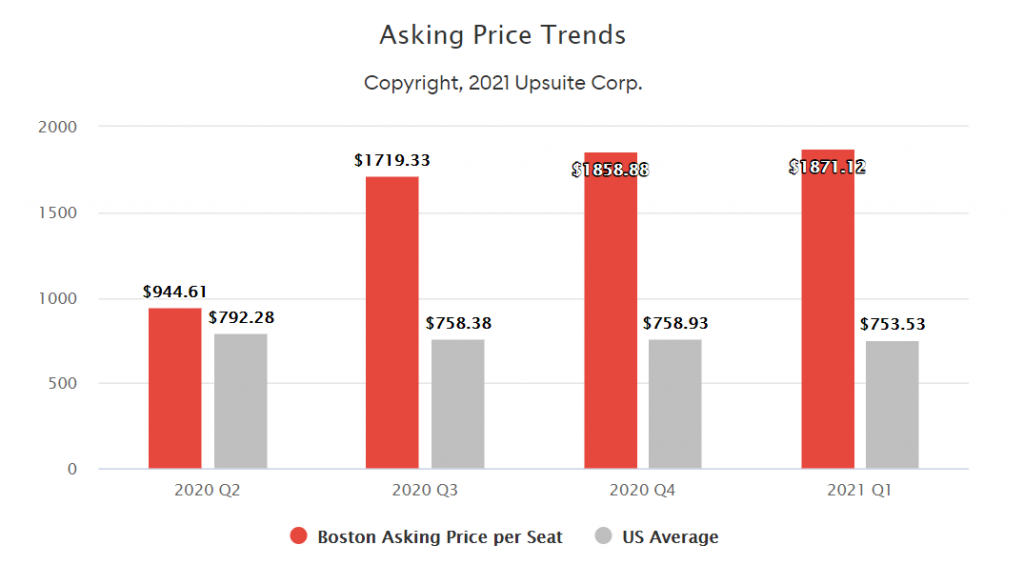

1. Boston

Boston is North America’s most expensive coworking market, with an average asking price per seat of nearly $650. And while average asking prices continue to drop slightly (-2% QoQ), it’s worth noting that Private Office pricing in Boston has spiked as a result of the pandemic need for safe social distancing in otherwise fairly dense coworking environments.

For floating desks, coworking trends show pricing has been decreasing since covid, for Private office, it jumped up nearly double from 2020 Q2 to 2020 Q3.

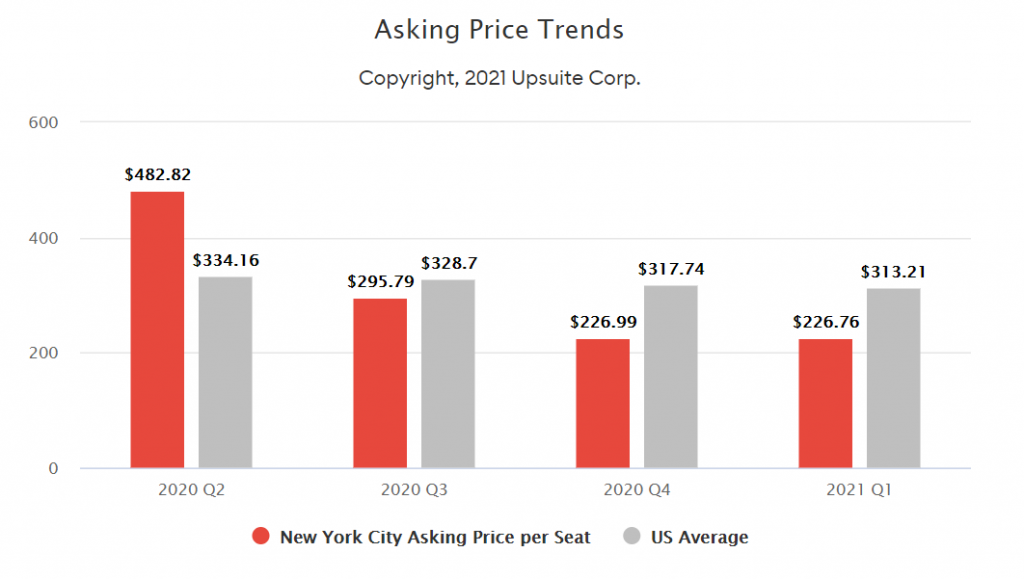

2. New York City

New York City boasts the largest coworking inventory in North America, with over 90,000 total seats. With real estate at a premium, it’s no surprise that NYC is also one of the most expensive coworking markets for occupiers. However, with only 10% of Manhattan office employees back in the office as of early March, coworking trends show that these average asking prices continue to decrease (-7% QoQ) despite demand starting to recover (+40% QoQ). Pricing particularly suffered for shared offerings like Dedicated Desks, where occupiers ready to act now could capture big discounts.

3. Austin

Austin is North America’s third most expensive coworking market, with an average price per seat of $514. With a 23% vacancy rate and demand trending up for the first time since the start of the pandemic, this market could recover if operators balance supply/demand with pricing.

4. Los Angeles

Los Angeles is North America’s 4th most expensive coworking market, with an average price per seat of $510 and rising (+2% since Q4 2020). Demand is also positively trending, up 46% since last quarter.

5. Minneapolis

Minneapolis has nearly the same amount of coworking inventory and average price per seat as Los Angeles ($500), making it the fifth most expensive coworking market in North America.

The Top 5 Least Expensive Coworking Markets

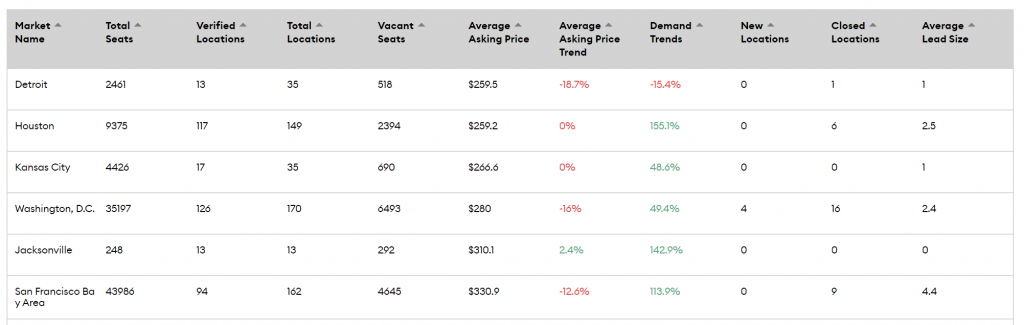

Detroit, Houston, Kansas City, Washington, DC and San Francisco are North America’s five least expensive coworking markets. Coincidentally, some of these markets are also experiencing some of the largest changes in coworking trends, with spikes in demand as operators grapple with an increasingly remote and decentralized workforce.

1. Detroit

Detroit is North America’s least expensive coworking market with an average asking price per seat of only $260. This price continues to fall at a rate of 18% QoQ as demand stays negative (down 15% since the end of 2020).

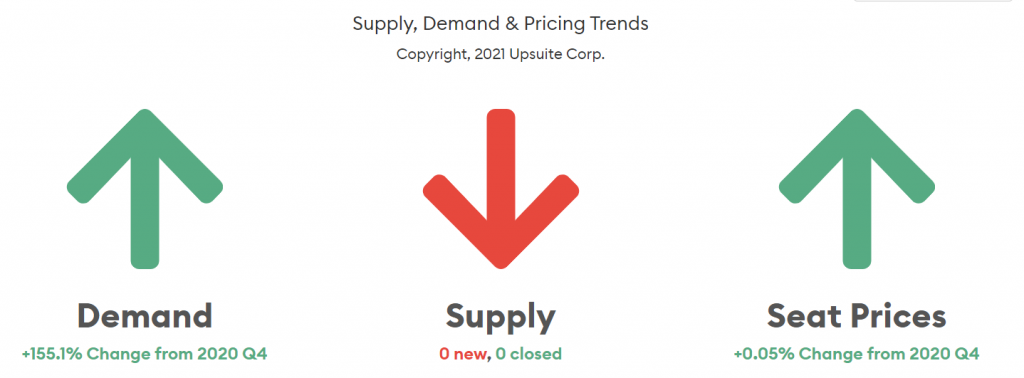

2. Houston

Houston’s average pricing per seat is also $260, but unlike Detroit, demand is up 155% since last quarter. This is no surprise as the state of Texas is leading the back-to-office charge, with much above-average space utilization as compared to the coastal gateways. Occupiers are keeping prices steady as they try to capture this new demand.

3. Kansas City

Kansas City’s average asking price of $266 makes it the third most affordable coworking market in North America. Prices in this lifestyle market have held steady and demand is back on the rise, with a 48% increase over Q4 2020.

4. Washington, D.C.

Washington, D.C.’s average asking price per seat clocks in at only $280, making it the most affordable coworking market on the east coast. This is the result of a 33% price drop compared to the same period last year (Q1 2021, pre-pandemic). Pricing continues to drop QoQ at a rate of 16%, but demand has increased 50%.

5. San Francisco

San Francisco is the largest coworking market of the top 5 most affordable, with over 40,000 total seats. Similarly to D.C., its average asking price per seat of $330 also makes it the most affordable one on the west coast. And while prices continue to fall at a rate of 13% since last quarter, demand has doubled and continues to rise.

The 5 Most Stable Coworking Markets for Pricing

Not all markets have experienced high pricing fluctuation in North America. For the following five markets, average asking price per seat has remained incredibly stable in spite of the pandemic. While this could be due to a variety of factors, it is worth noting that, with the exception of Brooklyn (though arguably also far less dense than Manhattan), these markets are located in lower-density lifestyle markets that were not as hard hit by the urban exodus last year.

- Brooklyn

- San Diego

- Miami

- Raleigh Durham

- Salt Lake City

The 5 Least Stable Coworking Markets for Pricing

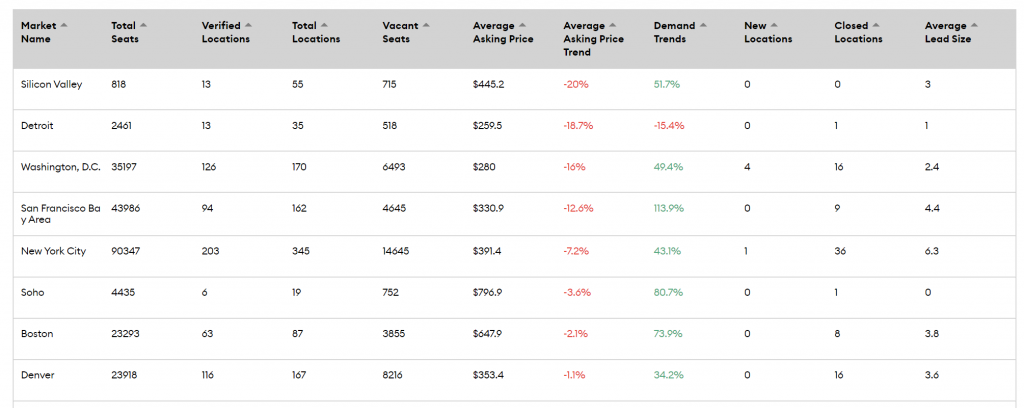

The five markets that saw the largest change in pricing are also some of the largest in terms of coworking seats (SF, NYC). These cities continue to experience price drops of up to 20% since Q4 2020.

- Detroit (-20%)

- Washington DC (-16%)

- San Francisco Bay Area (-12.6%)

- New York City (-7%)

- Denver (-1%)

What this Means for Occupiers

As an Occupier, when is the best time to buy? In short, the answer depends on the coworking trends in your market. If you are in a market that has and continues to see pricing decreases, like Detroit, Washington DC, San Francisco or New York City, then you could expect discounts if you act now. Conversely, if you are in a market that has held pricing, like LA or San Diego, then you may not get as many discounts as you’d like.

What this Means for Operators

The pandemic has shown that pricing has more to do with supply and demand than the underlying real estate costs. To recover and grow, this pricing will have to align with occupier demand. If your pricing is dramatically above market, know that you may lose opportunities. Concentrate your attention on markets where that demand is returning, like Houston, Los Angeles, San Francisco, and Tampa. To continue to track coworking activity and decide on your next steps, you can start by:

1. Read our upcoming forecast for Q2 2021 pricing.

2. Get the data to understand key coworking trends across North American coworking markets.

3. Schedule a meeting with one of Upsuite’s advisors

We hope that this post is helpful as you decide what to do next. If you have questions or want to talk, please schedule a call with us to discuss your options. We are here to help.

This Post Has 0 Comments